prepare your students for real life…even if your school can’t do it all.

available on Chromebooks and iOS devices

ceiy is a plug and play literacy platform that teaches money, career skills, and entrepreneurship, so students see how school connects to real life.

we are trusted by

the problem

when students stop seeing the point of school, everyone loses.

ceiy offers innovative tools that equip students with life skills. our platform is designed to support teachers while enhancing student engagement and success.

financial literacy is taught with outdated, abstract curriculum.

students tune out because they don’t see the value

teachers patch together lessons from Youtube or worksheets

teachers burn out trying to make it work

many edtech tools fail to meet standards or relevance

schools lose families — and funding

ceiy makes education real again

our plug and play, culturally relevant platform helps students build financial confidence and career skills that actually matter — while saving teachers hours of prep and helping districts sustain and grow enrollment.

engage students with real life learning

identity-based scenarios and modern topics helps students connect school to their future, so they stay interested and remember what they learn.

empower teachers with ready-to-use tools

each lesson comes with pre-built guides and slides — saving teachers hours every week and making it easy to deliver meaningful instruction without added stress.

justify investment with skills that meet standards

lessons are built to meet financial and career literacy and teach life-readiness, so districts can show ROI and real student growth beyond test scores.

ceiy connects students’ learning to real life in 3 steps

how it works

ceiy transforms education by providing practical skills that students can apply immediately. our approach supports teachers while enhancing student engagement and retention.

step 1: start with context that makes sense

each lesson starts with a quick, relatable set up and clear takeaways.

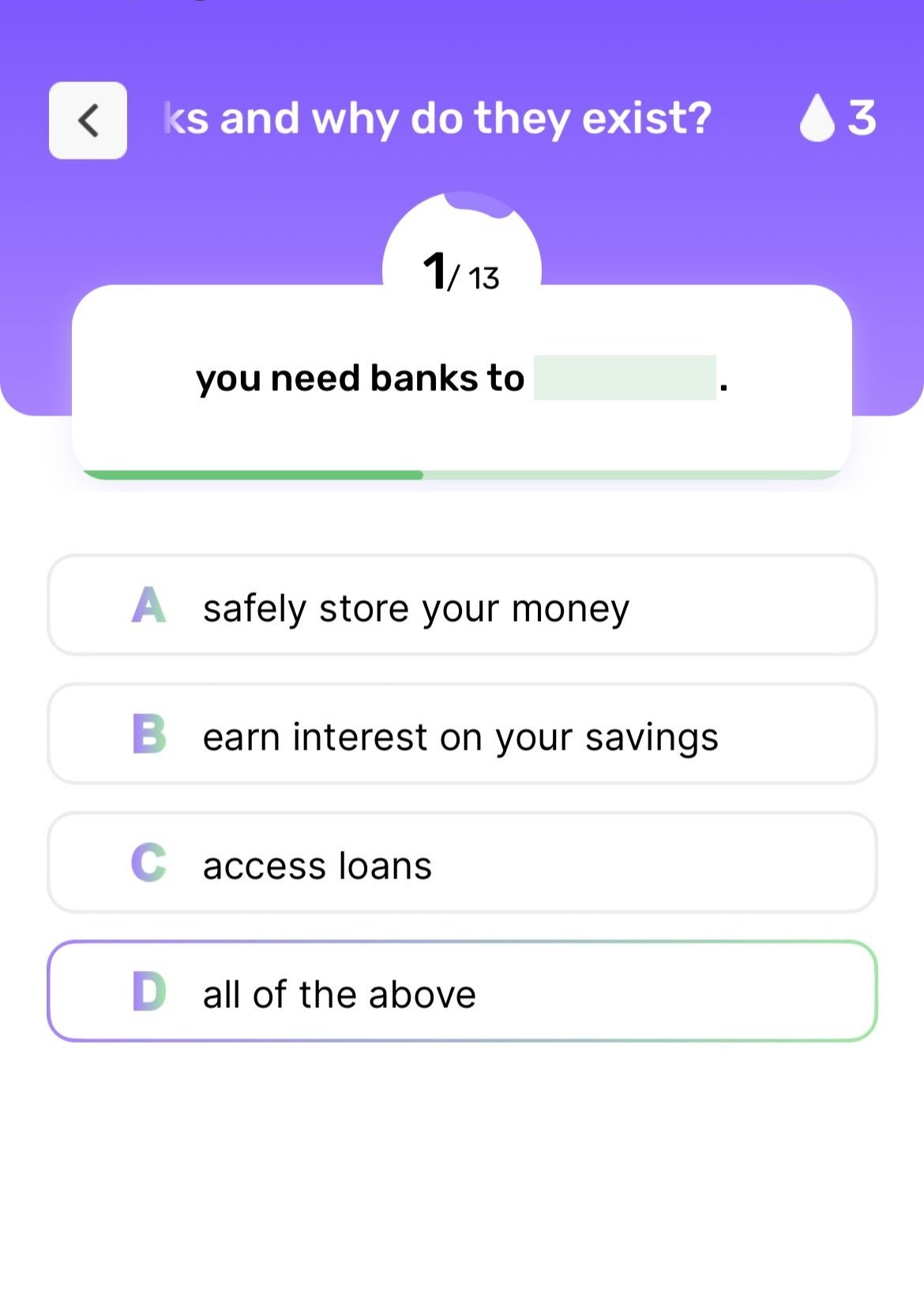

step 2: build critical thinking through engaging activities

students answer guided questions and do hands-on activities that help them learn.

step 3: apply learning to real-world decisions

from budgeting to career moves, students practice using scenarios that mirror real life.

here’s what educators and students have to say

the ceiy difference

culturally relevant curriculum

ceiy offers an easy-to-implement curriculum steeped in the realities that under-represented students face, making financial education relevant and relatable.

adaptive learning & real-time support

we provide dynamic, real-time support levels that adjust to each student’s learning needs without adding to teacher workloads, advancing educational equity.

community collaboration

developed in parntership with educators and financial experts from the communities we serve, ensuring our tools reflect the values and needs of our users.

sustainable impact

our platform is designed to effect long-term change, equipping students with skills that foster personal growth and community enhancement.

FAQs

find answers to common questions about our literacy platform and its benefits for students.

-

ceiy is a literacy platform designed to empower underserved students with essential life skills.

our approach focuses on real-world applications, ensuring students can utilize what they learn immediately.

This helps to create a more engaging and effective learning environment.

-

ceiy integrates practical lessons into the curriculum, allowing teachers to deliver impactful education without added stress.

our platform provides resources and support to enhance teaching methods.

this collaboration helps districts improve student outcomes and retention.

-

ceiy is designed for public school districts, particularly those that serve under-resourced communities.

educators and administrators can leverage our platform to enhance student learning experiences.it's tailored to meet the unique challenges faced by these districts.

-

by using ceiy, districts can improve student engagement and outcomes.

our platform reduces teacher burnout by providing effective tools and resources.

additionally, it helps to maximize return on investment for educational initiatives.

-

yes, we offer comprehensive training for educators to ensure they can effectively utilize the platform.

our support team is available to assist with any questions or challenges.

we are committed to making the transition as smooth as possible.

-

yes. ceiy is built with compliance in mind. our curriculum aligns with national and state standards for financial and career literacy.

ceiy is also fully FERPA-compliant —we don’t collect or share personally identifiable student information without consent, and our systems follow strict data privacy protocols to protect students and schools.

still have questions?

we’re here to help! share your contact information below and we’ll be in contact shortly.